Market and competitive scenario

The metal powder market has various applications in transportation & logistics, industrial, construction, electrical & electronics, and others. The increase in demand for powder metallurgy manufactured components has driven the growth of the metal powder market. Growing demand for sustainable products due to the need for reducing the environmental impact of the metal industry has resulted in the increase in the demand for metal powder. The growing preference of metal powder for sustainable and innovative production and manufacturing technologies will also drive this market. Non-ferrous metal powder is expected to grow due to the demand from existing and emerging end-user industries.

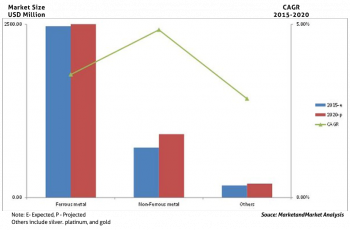

Metal Powder Market Size, by Types 2015-2020 (USD Million)

The market for metal powder is observed to be matured in developing economies such as Europe and North America. The reason behind this is the high disposable income. The Asia-Pacific region is projected to be the fastest-growing market with the highest CAGR of 5.0% during the forecast period. North America accounted for the largest market a share of 40.4% in 2014. The global market for metal powder is projected to grow at a CAGR of 3.80% from 2015 to 2020 and is projected to overcome USD 4.000,00 Million by 2020.

The metal powder market will be driven by the demand from end-use industries and technological advancements. The development of economies plays an essential role in increasing the demand for metal powder in the global market. The key parameters that determine the growth of metal powder in developing economies are increase in consumption and demand for value-added & sustainable products.

The global metal powder market is marked with intense competition due to the presence of a large number of both, big and small firms. Mergers and acquisitions, investments, and expansions are the key strategies adopted by market players to ensure their growth in the market. Companies such as Sandvik AB (SW), Carpenter Technology Corporation (USA), Hoganas AB (SW), GKN Plc. (UK), Rio Tinto (UK), and Allegheny Technologies Incorporated (USA) are some of the prominent companies in the metal powder market.

Metal Powder for Additive Manufacturing

The boom in additive manufacturing will drive significant growth in the area of metal powders optimized for use with 3D printers.

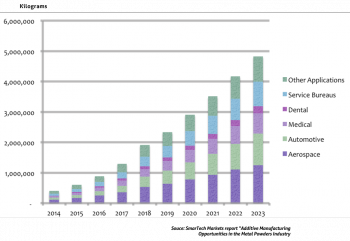

Total AM Metal Powder Demand by Industry (Kg)

The metal powder industry, historically serving traditional powder metallurgy production techniques, is embracing additive manufacturing as a growing source of demand over the next ten years, with demand for metal powder used for 3D printers growing to 5,0 million kilos in 2023 (more recent estimations, updated to market growth rates and installed production capacity worldwide shift this limit to 10,0 million kilos by 2025).

The expectations are that 3D printing/additive will consume around $500 million in metal powders by 2018 growing to $1000 million by 2023 (about the double as per more recent estimations). Leading the development of manufacturing metals parts with metal powders has been the aerospace industry, which expects to consume around 33% million in 3D metal powders by 2019. Strong growth rates are expected for both energy (Oil&Gas, power generation) and automotive industry (including fine mechanics). Meanwhile, the use of metal printers in service bureaus are creating more and more demand for metal powder material, as bureaus seek highest possible utilization rates for their printers to control manufacturing costs. By 2019, service bureaus are expected to consume almost 20% in metal powders for 3D printing.

This said independently on new metal alloys and production technologies.

The supply chain for metal powders for additive manufacturing is potentially robust, as production processes for metal powders have been utilized for decades, with hundreds of thousands of tons of powder being supplied to manufacturers across the globe each year.

A technology gap is still existing represented by the metal powders specialization for each new additive technology, with challenging targets in terms of morphological parameters and qualitative levels for materials, whose relationship with process parameters is far to be easy or banal and therefore subject for future technology developments. Not to say about the wide range of new materials and alloys to be designed and tailored, with no correspondence with conventional technologies, asking for fundamental efforts in R&D and a strong cooperation between 3D printing experts and metallurgists to serve the market with the proper optimized solution.

This said, powder metallurgy has a quite interesting and challenging future, characterized by a high innovation level, needed to accelerate the qualification of 3D printed components for high value-added engineering applications.